Charitable Giving is a Tax Saver

by Danielle Woods

The new priorities of the federal administration have long-reaching ramifications for taxpayers and federal aid recipients. The new One Big Beautiful Act (OBBBA) that was signed into law on July 4, 2025, includes significant changes for most Americans. In this blog post, I’m going to cover some of the basic tax cuts of the OBBBA, the QCD tax benefit available to retirees, and how these tax cuts and others will give private citizens more control over their community support dollars. Keep in mind that these tax rules apply to federal tax only. You should always consult your tax preparer to determine the impact, if any, on your state taxes.

The OBBBA: Changes Impacting Most Taxpayers

When filing your 2025 federal tax return using the standard deduction, each taxpayer will enjoy an extra $750 deduction. Seniors 65 and older could be getting an additional $6000 deduction each.

If you itemize deductions on your tax return, you could deduct as much as $40,000 in State and Local Taxes. That’s an increase from the previous maximum of $10,000 in effect since 2018. Also, if you buy a brand new car, you could deduct up to $10,000 in vehicle loan interest.

The Child Tax Credit is going up too from $2000 to $2200 for children aged 16 and under.

Health Savings Accounts (HSAs) will now be allowed for anyone who has a Bronze or Catastrophic Plan through the ACA, or Healthcare.gov. These plans are typically cheaper than the Silver and Gold plans but previously it was difficult to take advantage of a tax-efficient Health Savings Plan. HSAs allow tax-free contributions up to $4300 for single plan owners and $8550 for family plan owners with an addition $1000 catch-up for taxpayers aged 55+.

Examples: How Do These Changes Translate into Dollars?

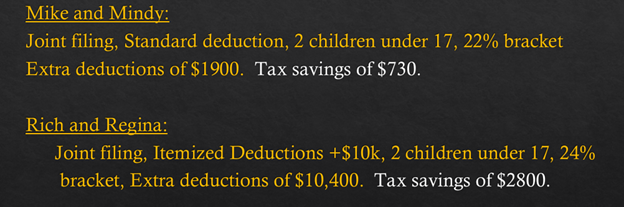

Mike and Mindy file jointly and have taxable income between $90,000 and $190,000. The Taxpayers are in the 22% tax bracket. They have 2 children under 17 years old, which means they will have an additional standard deduction for 2 adults and additional child tax credits for 2 kids. Their total tax savings is over $700 this year.

Rich and Regina file jointly with taxable income between $191,000 and $364,000. They will be itemizing deductions and can take advantage of an additional $10,000 this year in state and local tax deductions as well as the additional credits for their 2 minor children. Their tax savings is $2800 for the year.

The Largely Unknown QCD: Qualified Charitable Donation

While not new, it’s worth mentioning the QCD. For Retirees over the age of 70 ½, there is an amazing tax avoidance strategy that is completely legal and benefits your community! It is called the Qualified Charitable Deduction or QCD for short. You are allowed to send up to $108,000 from your pretax retirement account (which is an account you’ve never paid taxes on before) to charities of your choosing, and it is tax-free. It also has the added benefit of reducing the value of your IRA for future Required Minimum Distributions that must begin at age 73 whether you need the money or not.

For example, Bob who is 73 years old and wants to support his community and not pay federal taxes. He is required to take an RMD of $10,000 this year, which would cost him $2200 in federal tax. Instead he sends $10,000 to his local veteran’s nonprofit. Because he sends it directly from his IRA account, he pays no federal tax on the distribution and meets his RMD requirement.

It is very important that you or your tax preparer know how to report these transactions to the IRS properly.

What Do Charities and Nonprofits Actually Do?

Everyone loves to pay less in taxes, but it’s important to know where these tax cuts come from. We are seeing a marked shift from federal support to community support as it applies to our most vulnerable residents including the elderly, children, low-income workers, the physically and mentally disabled, veterans and injured public servants such as police officers and firefighters. Preventative measures are offered by local charities and nonprofits in the form of services, education, and basic living necessities.

This support can be categorized as proactive. Its goal is to address problems before they start. It mitigates the need for the reactive involvement of law enforcement, the courts, and public educators.

Due to the changes in federal funding priorities, many nonprofits are losing a considerable amount of funding with which they accomplish their missions. Not only will our communities see a reduction in resources for healthcare and education, many taxpayers who work in nonprofits will lose their jobs.

Curious about a local nonprofit? I encourage you to call them. They will be glad to share with you what they know and why they do what they do. Engaging with your community can be educational as well as gratifying.

Danielle’s Nonprofit Example

For example, my favorite local nonprofit is Be Aware Blount. It is a student-focused coalition that partners with local law enforcement, healthcare providers, and public educators to educate about 18,000 students and their caregivers about the dangers of substance misuse and overdose in our community. Blount Co TN is on the federal DEA list of High Intensity Drug Trafficking Areas because of its convenient location between Detroit and Atlanta.

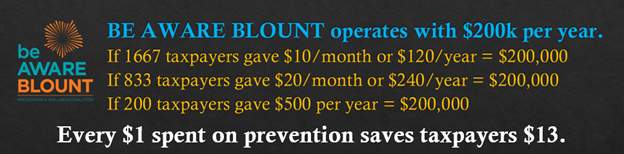

The nonprofit is staffed with 2 full-time staff members, 2 part-time staff members and over 30 adult and student volunteers. Their annual budget in 2024 was less than $200,000. Now all of those funds are at risk of being taken away because of budget cuts at the federal level.

$200,000 sounds like a lot of money, doesn’t it? But what would it really take to keep nonprofits like Be Aware Blount, not only able to continue their good work, but to thrive?

If 1667 taxpayers gave up one day at Starbucks each month and contributed it to Be Aware Blount, that would raise an entire year’s budget for the kids in this community. If 833 taxpayers gave the equivalent of their Netflix membership each month to nonprofits, it would raise an entire year’s budget. If 200 taxpayers gave $500 per year, the nonprofit would be fine.

Be Aware Blount tells me that every $1 donated to prevention saves taxpayers $13 in the form of public expenses like law enforcement, firefighters, and court administrators.

Consider donating to Be Aware Blount at https://beawareblount.org

In Conclusion…

To recap, the money we save in taxes from the OBBBA is coming from cuts made in federal funding to the needy in our communities. Reducing preventative funding is likely to lead to reactionary spending that we will pay for in state and municipal taxes. Preventative spending is far less expensive, and it gives you, the taxpayer, the freedom to choose where to send the funds. Also, in 2026, there will be some additional deductions for charitable contributions even if you do not itemize. That will make it even more affordable.

Some of these deductions that I mentioned are limited by your total income, so consult your tax preparer about your personal tax returns. If you have any additional questions, please let me know!